Which One of the Following Best Describes Subprime Mortgage Lending

If interest rates are much higher now than when this bond was issued the coupon rate of that bond will likely be below the prevailing. A borrower with a 610 credit score is offered a subprime loan.

Pros And Cons Of Subprime Mortgages

Which of the following best describes and air loan.

. Which of the following formulas best describes the value of a bond. Underwriting is the process of evaluating both the borrower and collateral to ensure that lender guidelines are met. Quite often subprime borrowers have been turned down by traditional lenders.

The final payment is a balloon payment. Because home loans are backed by a borrowers real property a predatory lender can profit not only from loan terms. The correct answer is D.

The down payment will be low or not required. Which of the following best describes a loan with a principal balance exceeding Fannie Mae or Freddie Mac guidelines. B it is where loans originated in the primary market are sold.

No tax returns needed. One name for this second mortgage is. Subprime lenders charge higher interest rates D.

A partially amortized loan is a self-liquidating loan. Loan amounts up to 3 million. Consider a coupon bond that sold at par value two years ago.

Lending to people to buy houses who are at greater risk of being unable to meet the repayments c. An individual securitys total risk. The lifetime cap is 8.

The margin is set at 4 and the current index value has risen in the last month to 925. Which of the following statements best describes the secondary mortgage market. Subprime loans are sometimes made to low-income and risky borrowers B.

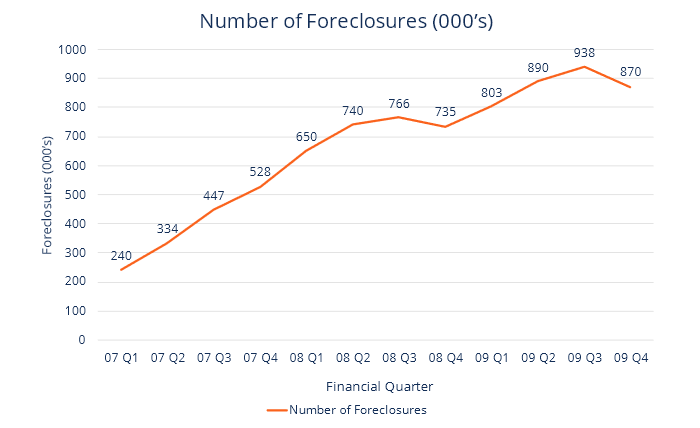

AThe value of homes remained higher than the mortgage so foreclosures decreased BMany people with subprime mortgages could not make their payments so foreclosures increased CBanks offered more subprime mortgages to avoid further foreclosures. Risk that affects a large number of assets C. D it is the market where second mortgages are originated.

90 LTV on personal and business. 3What relationship existed between subprime mortgages and foreclosures when home prices fell. A borrower with a 610 credit score is offered a subprime.

A subprime loan is a type of loan offered at a rate above prime to individuals who do not qualify for prime-rate loans. All of the following statements are true about a partially amortized loan except. To accommodate risk subprime lenders will charge higher closing costs and processing fees C.

See the answer See the answer done loading. Responsible MLOs and underwriters will want to see compensating factors such as larger down payments or secondary financing to ensure that the loan can be paid off. Want to read all 4 pages.

A fictitious borrower obtains a loan and secures it with a. Which one of the following describes systemic risk. A bank lending to someone who is not one of their customers b.

These loans will remain in a lenders portfolio rather than be sold on the secondary market. A False this information must be given to the applicant in person. Credit scores as low as 600.

A subprime loan is a type of loan offered at a rate above prime to individuals who do not qualify for prime-rate loans. The interest rates are often mixed with the first two to three years at a fixed rate and the subsequent years adjusted to the fully indexed rate. Under The Guidance on Sub-Prime Mortgage Loans the CSBS considers all of the following to be a predatory lending practice except.

C it is where loans made only by private parts are sold. The interest rate will be unconventional. B True as long as the applicant consents and can access the information.

PV of bond C 1k1 C 1k2. 50 DTI with scores as low as 600. A 7 1 ARM has a start rate of 4 an initial cap of 3 and a periodic cap of 1.

43 All of the following statements are generally true about subprime lending except. Lending to people who do not have a bank account Answer. The most common type of fraud involving.

Risk that affects a. Lending on overvalued properties d. A it is the market where second mortgages are sold.

Quite often subprime borrowers have been turned down by traditional lenders. An individual securitys total risk B. Prohibiting discrimination in mortgage lending transactions.

Subprime mortgages are known for their high interest rates which lenders use to offset the risk involved. Lending to people who do not have a bank account Ans. Subprime loans are still being made today even in California.

12 months personal bank statements and 24 months for business statements. Finance questions and answers. The periodic payments do not fully amortize the loan by the end of the term.

Landing to people to buy house who are at greater risk of being unable to meet the repayment describes subprime mortgage lending because of great practice in America before 2007 because the price of the house was increasing significantly. Their subprime programs have some of these feature and benefits. ECOA A mortgage broker may inform an applicant that Federal law requires the broker to ask about the race sex marital status and age by putting the information on a web site.

Risk unique to a firms management. Which one of the following describes systemic risk. A Basing a loan off the foreclosure value B Refinancing a borrower repeatedly to collect more fees C Charging higher rates too risky buyers D Using fraud or deception to sell the loan.

This problem has been solved. Subprime mortgages Classic predatory lending centers around home mortgages. Secured by an undisclosed and unrecorded second mortgage.

Provide comprehensive training and facilitate responsible behavior to expand the subprime mortgage marketplace. Subprime lenders are predatory lenders. Which one of the following best describes sub-prime mortgage lending of 2008.

The Subprime Mortgage Crisis Causes And Lessons Learned Module 4 Of 5

The Subprime Mortgage Crisis The Financial Appetite

How Can America Survive From Current Financial And Economic Crisis Subprime Mortgage Crisis Business Ethics Capital Market

Subprime Mortgage Overview Types Advantages And Disadvantages

Subprime Mortgage Overview Types Advantages And Disadvantages

Subprime Mortgage Crisis Wiki Thereaderwiki

Creation Of Tranches From A Portfolio Of Subprime Mortgages Download Scientific Diagram

Subprime Mortgage Originations Annual Volume Download Scientific Diagram

No comments for "Which One of the Following Best Describes Subprime Mortgage Lending"

Post a Comment